.jpg)

15 Years experience in Share market

Give 90%-100% Accuracy signal

Give full support any time

Put Login access for start algo trade

Within Hours available for trade

90%-100% Accuracy available

40% Profit sharing option Available

Give free training and Algo alerts

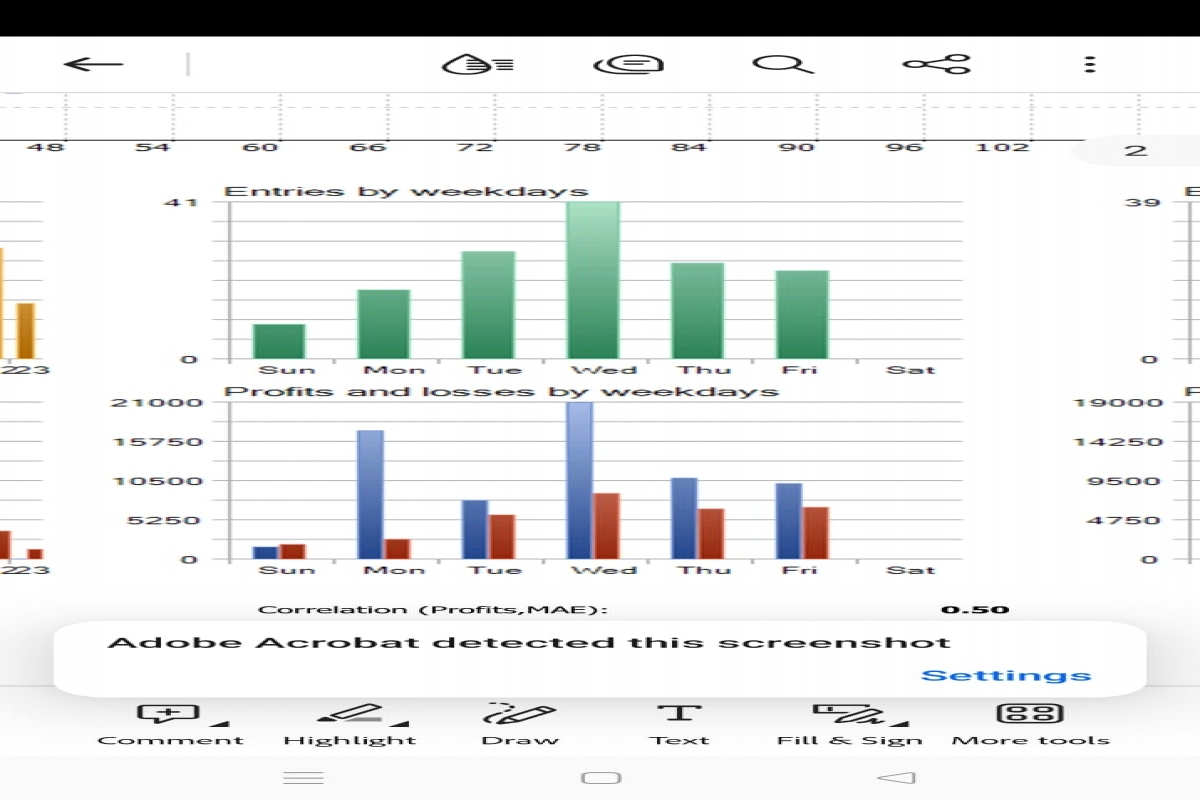

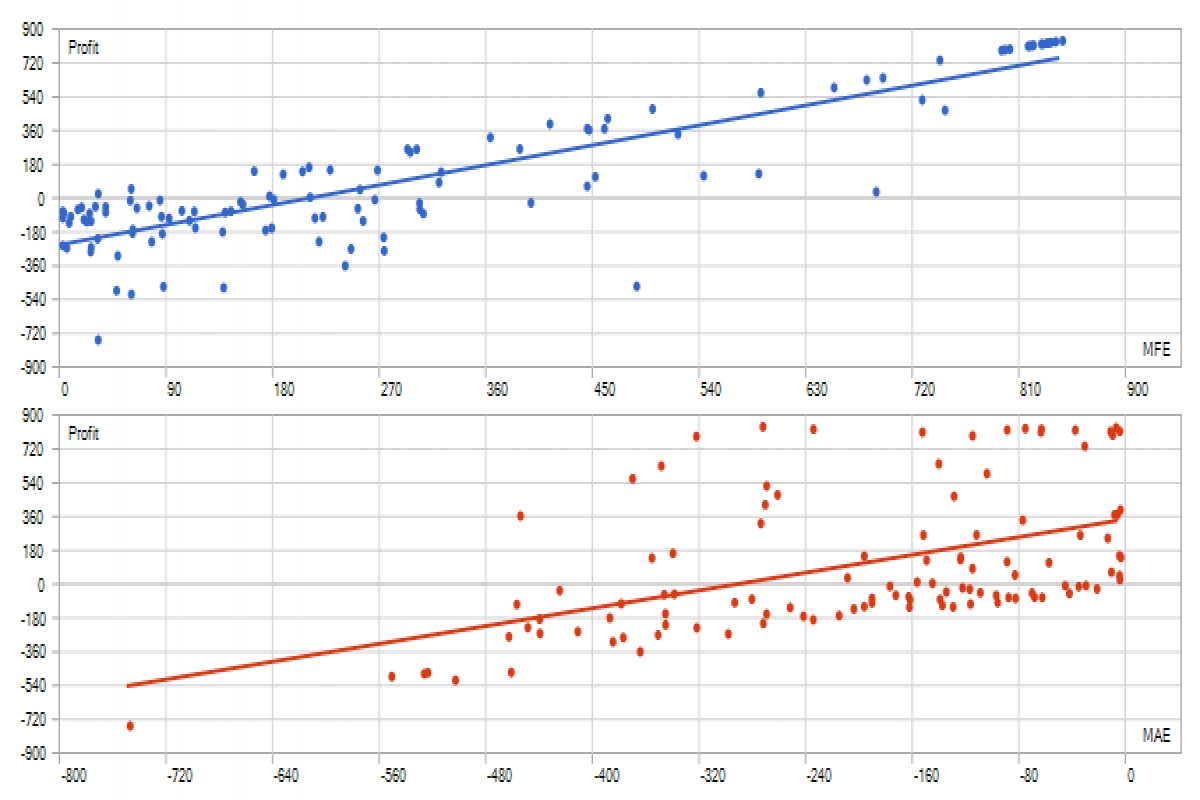

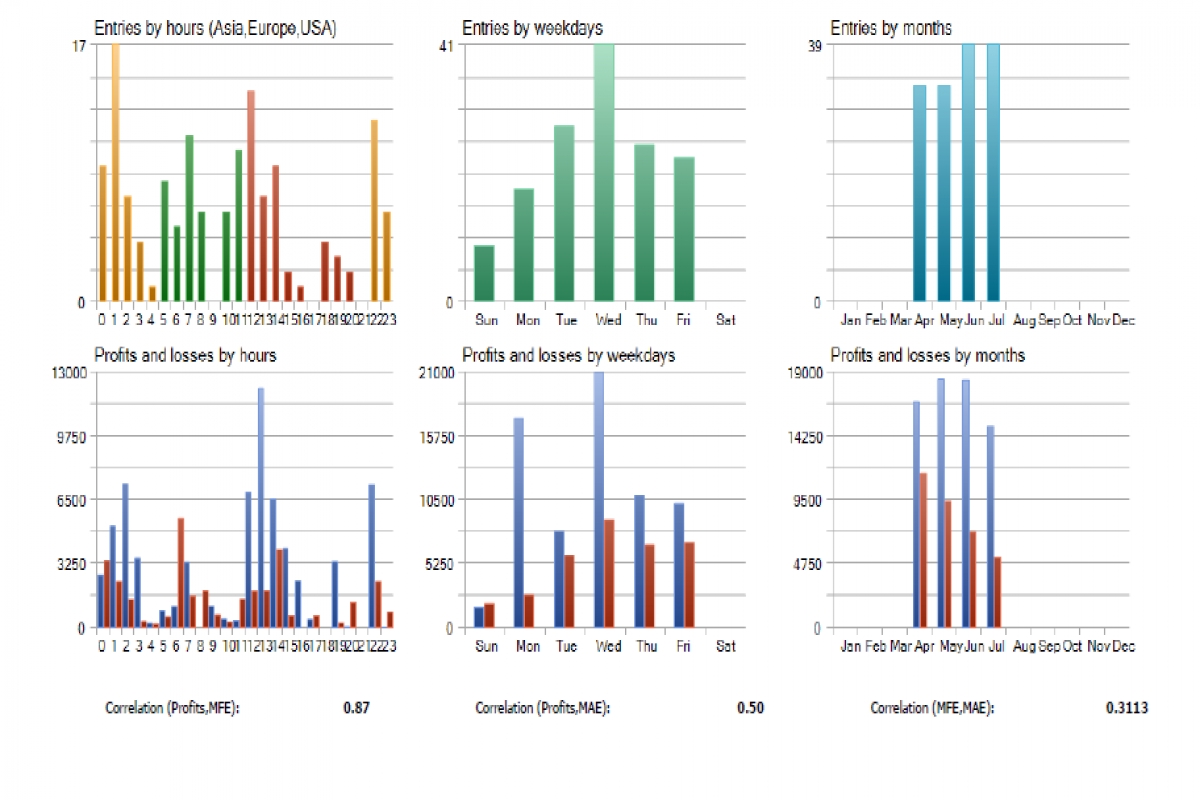

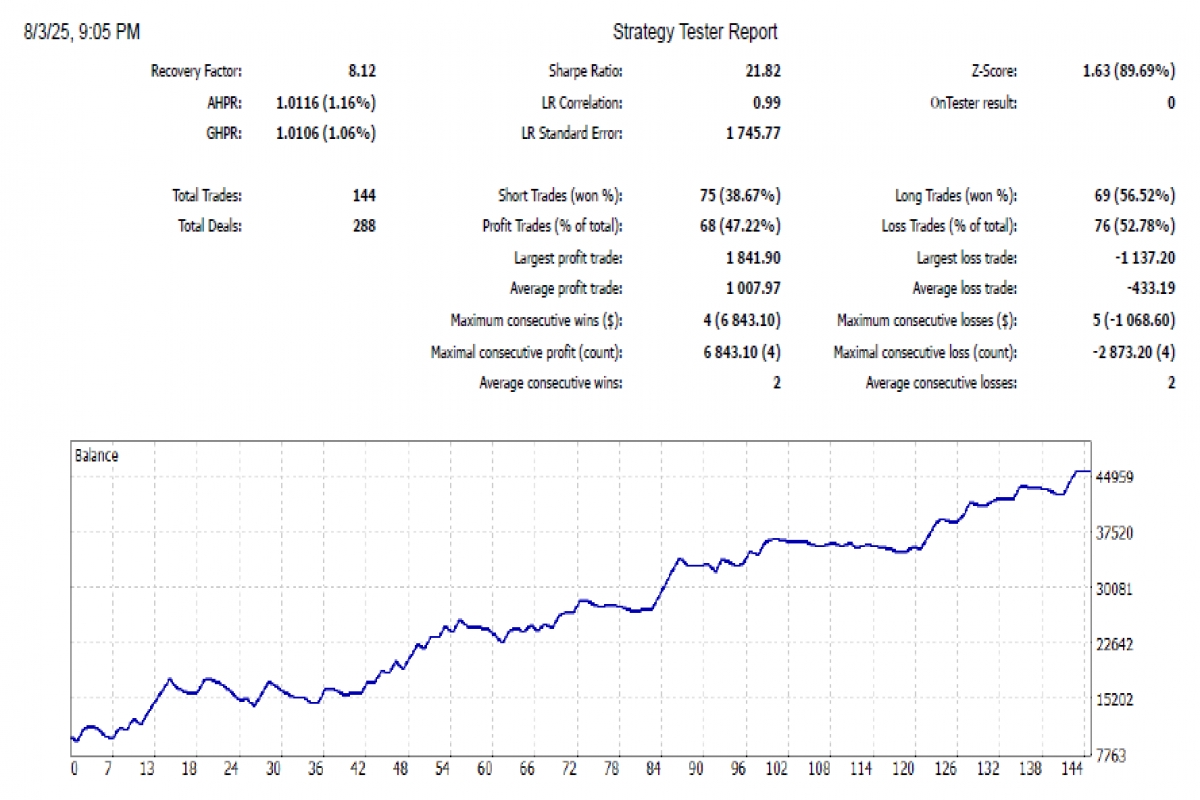

XAUUSD Strategy for Bot trading very good